CuriosityStream: Asymmetric Risk Vs Reward

Analysis of Curiosity Stream

Summary:

- Curiosity Stream is a speciality SVOD (Subscription Video on Demand) that specialises in factual content. Think “Netflix for documentaries.”.

- The market cap of Curiosity Stream is 64M. However, it has ~66M in net current assets. Priced to go bankrupt but is highly unlikely to go bankrupt.

- Has further upside potential due unique business model and moats.

Balance Sheet Analysis

I’m starting with a Balance Sheet Analysis first as the current valuation can be justified just with the balance sheet:

66M in net "cash"

Curiosity Stream has 91.84M dollars in current assets and 25.65 in current liabilities. This excludes unearned revenue liability as it's a non-cash account - CURI "owes" its customers 22M worth of content, and it services this liability simply by continuing to operate the service. This means they have 66.19 in net current assets.

8M in valuable equity

As of Jun 2022, Curiosity owns 8M of stock in a private start-up called Nebula. Curiosity also has the option to buy up to 25% of Nebula (Valuing Nebula at 50M in 2021). About Nebula: Nebula is a creator-owned streaming site with more than 500k subscribers (reported 2021). The top YouTubers are on Nebula, with a cumulative reach of 200M subscribers. On Nebula, you get to watch videos from your favourite YouTubers first, with extra content and exclusive content only found on Nebula. This is an excellent value proposition from the customer side. Nebula is already profitable, according to the CEO. With growing paid subscribers, Nebula's value has most likely increased in 2022, which is not reflected on the balance sheet. Nebula’s Youtubers have a combined reach of 200m and are interested in factual content. Netflix, for example, has about 200m+ subscribers. CuriousityStream is the only outsider investor, and even VCs cannot get an allocation. Curiosity Stream only managed to get an allocation as it has worked together with Nebula for multiple years, building the relationship; To put simply, this means the stock is precious. Most importantly for CURI, because of this partnership - you have top YouTubers constantly marketing Curiosity Stream and Nebula Bundle. CURI has a straightforward way to grow its subscribers.

78M in content assets

As of Jun 30, 2022, CURI has 78M in content assets, valued at cost. Management believes it is worth 5x as much (390M). Usually, I would ignore intangible assets as it is hard to value; however, in the streaming wars, content is precious to prominent players such as Netflix, Apple, Disney & Amazon (who routinely spend 100m for a single title). I see a scenario where CURI can better monetise these libraries by licensing them out or outright selling them at cost. They do currently license their content out already. CURI can generate 71M in revenue in 2021, and LTM - 85.96M, so their ability to monetize their library seems to be improving quickly.

Selective Book Value calculation

Selecting for the most tangible assets, excluding everything else (other intangibles, PPE, etc.). Results in 152M of Book Value

66M in net current assets (this already covers the market cap)

8M investment in Nebula

78M in the content library.

With no debt, the current market cap of around 64M implies at least of 100% gain just by the book value.

Will CURI go bankrupt?

Given that the CURI market cap is valued at less than its current assets, the market implies that the CURI sum of future cash flows will be slightly negative. i.e. it will go bankrupt.

Will CURI go bankrupt?

In my opinion, no, and I have three reasons.

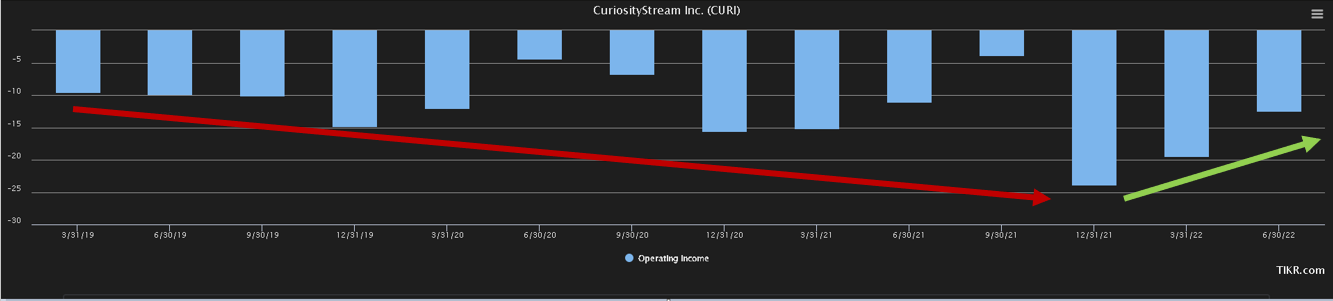

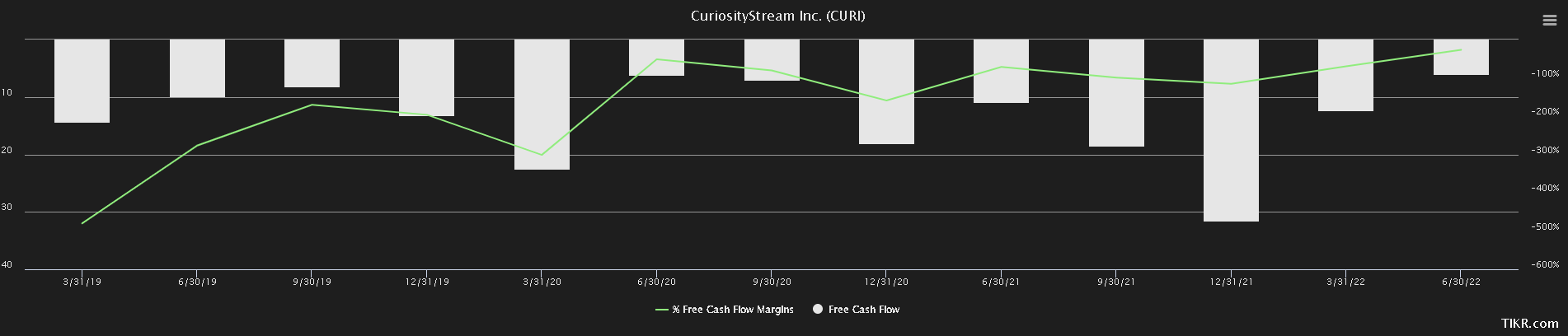

Reason 1: Improving FCF

Firstly, the management has guided positive cash flow in 2023. Should we believe them? Looking at the Cashflow Statement, we can see that the free cash flow margin has steadily improved from -300% to just -26% last quarter. CURI is on the verge of producing positive cash flow; if that happens in 2023, there is 0 chance of bankruptcy.

Reason 2: Management

Secondly, the Chairman of CURI, who owns 40% of CURI, is John Hendricks - the founder of Discovery Channel. He has a net worth of 800m, with his real estate portfolio worth 280M by itself. Let's assume CURI somehow does run out of cash. If Hendricks wanted to, he could buy out the whole company with 1/10 of his net worth. Indeed, he does not need to take such drastic action; he can inject a small amount of cash into the company to tide it over hard times if more capital is genuinely required. This is his passion project anyway; he left Discovery because he disliked that it made more reality TV shows rather than factual content.

Reason 3: Unit Economics

Thirdly, the unique thing about the SVOD industry is there is little to no marginal cost to serve media. If it comes down to it, management can cut advertising, lay off employees except for the technical stuff, and just let the servers stream videos. This is a structurally profitable company. Management is trying to grow its way to profitability. However, they can quickly reduce costs as well to reach there.

Potential Risk and why is it so cheap?

Every once in a while, the market provides a free lunch, and this appears to be one. If we can explain why we have the free lunch, we can build conviction in the investment.

Bear Argument related to the company

The primary bear argument is that the company is unprofitable and will remain unprofitable. This means it will go bankrupt or potentially need a capital raise.

However, the reason why CURI is unprofitable is that the company was in growth mode. Since 2022, management has been committed to reaching positive cash flow by 2023; as a result, the operating loss has decreased significantly in Q1 and Q2 2022.

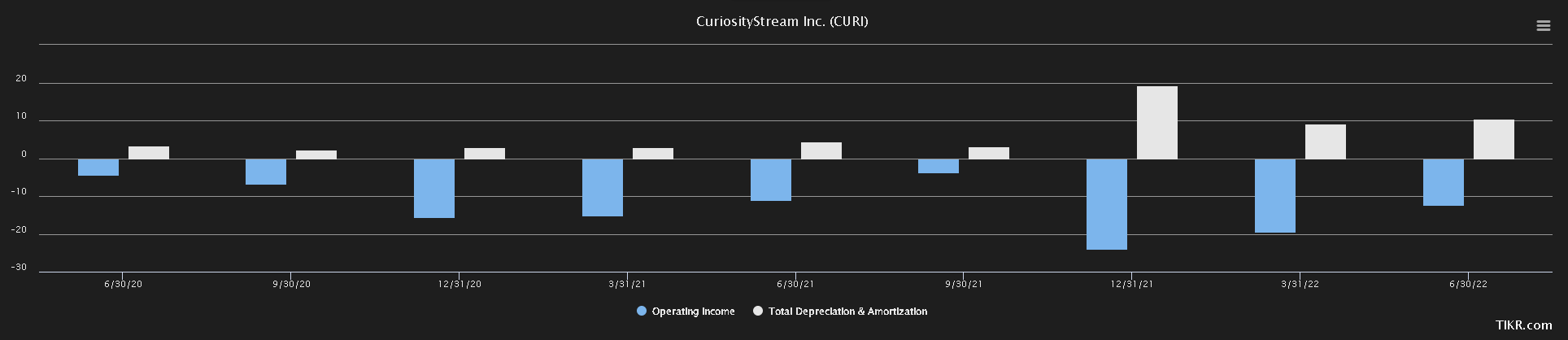

Upon further analysis, the operating loss is primarily driven by the amortization of their content assets, which is a non-cash expense. From CURI, 2021 10k:

Company amortizes content assets on an accelerated basis in the initial two months after a title is published on the Company’s platform, as the Company has observed and expects more upfront viewing of content, generally as a result of additional marketing efforts. Furthermore, the amortization of original content is more accelerated than that of licensed content. We review factors that impact the amortization of the content assets on a regular basis and the estimates related to these factors require considerable management judgment. The Company continues to review factors impacting the amortization of content assets on an ongoing basis and will also record amortization on an accelerated basis when there is more upfront use of a title, for instance due to significant program sales

They have a fiduciary duty to estimate how much their content "value" has reduced each quarter. There is undoubtedly a shelf life to a piece of content; news or sports, for example, have an extremely short lifespan. However, documentaries have a long shelf life, as facts don't change. Also, this accounting is tricky, as the actual video content has not "degraded" in quality, unlike machinery or tangible assets. The incremental customer can watch the video at the same quality. As an investor, you can believe they are being conservative, accurate or liberal with their estimations; I think that the best way is to avoid the income statement totally and look at the cash.

Looking at the cash flow statement, you can see that FCF remains roughly constant. On the other hand, revenue is increasing rapidly. Therefore, the FCF margins are improving to a large extent. Curiosity stream is instead on the verge of FCF profitability.

Bear Argument related to technical reasons

- Lack of momentum. CuriosityStream is "uninvestable" in the current market. It is a SPAC, Growth, Tech, Unprofitable, Micro Cap, COVID, Streaming stock. In 2022, these are not the characteristics you want. This explains why the market hates CURI.

- Microcaps are known to be illiquid and highly risky.

Rebuttal: Momentum can change when the economic sentiment changes or more coverage. Past price performance does not indicate future performance. Microcaps are also where you can potentially get the most gains.

Bear Argument related to the product

1) "Documentaries are undifferentiated & easy to copy by major SVODs like Netflix".

Rebuttal:

Documentaries are easier to make and less differentiated than big flashy blockbusters. However, this doesn't mean CURI will fail. I argue that focusing ONLY on factual content is the selling point; reducing the types of content is a feature, not a bug. There exist niche audiences that do enjoy documentaries, parents who want to buy this for children, and employers purchasing this for their employees...these people wish to buy a pure-play documentary service.

The real competition for CURI, I believe, is against other pureplay factual SVODs like Kanopy, Wonderium, MagellanTV, and HistoryVault. My thesis is that CURI currently has escape velocity and is one the most prominent player in the pureplay factual SVOD market - they win by being first, more extensive and faster.

2) I can find documentaries on youtube for free.

Rebuttal: The free Youtube documentaries argument doesn't hold, as the documentaries found on CURI are premium long-form documentaries. All SVODs are generally trying to produce premium content; if the youtube argument was valid, then we would all be unsubscribing to Netflix and watching free web dramas on youtube. Secondly, CURI is making FAST (Free Ad-Support Streaming TV) channels that are free and ad-supported. On a side note- related to the youtube argument - CURI is leveraging its partnership with Nebula to market those exact free Youtube factual content.

3) CURI documentaries suck.

From my personal experience using the product, it is a mixed bag. I'd agree that some content is pretty bad, but even Netflix or Disney have duds in their libraries. However, there are also real gems like the Titans of Wall Street and acquired content from the BBC. Over the long term, I believe with more capital, economies of scale, data and expertise, CURI will be able to produce and acquire higher-quality documentaries.

Ok, it's cheap, so what?

At this point in the article, the current valuation can already be justified with the balance sheet and has gone through the risk and bear arguments without discussing the operational business & income statement, which cover the downside. However, further analysing the business case - CURI does have some good qualities that allow us to hypothesize that CURI might be a good business.

High Revenue Growth

- Streaming is eating into Broadcast and Cable. Infact, Streaming overtook Broadcast and Cable for the first time

- Within Streaming - the rise of bundling & MVPDs like Roku, Amazon, and Youtube TV - CURI is an easy, inoffensive and cheap value-adding compliment for people's other SVODs or non-video services.

High Gross Margin

Negligible marginal costs after the initial upfront cost mean "Sofware-like margins" without sky-high valuations. Superior gross margin compared to industries selling tangible goods.

Compared to the other SVODs:

- Documentaries have longer "shelf-life" - more timeless (AKA less content spend)

- Easy to translate and internationalize to multiple languages

- Educating instead of brainless content - e.g. employers buying subs for employees, homeschoolers, Schools, and parents buying for their children. CURI already has a small portion of their revenue, but this can grow much more.

High Operating Margin

- Pure play streaming without the legacy networks & personnel overhead of Cable & Broadcast that are declining. No need to avoid cannibalising their cash cows, unlike Para, WBD, AMC

Moats

Why Curiosity Stream can defend profits:

- "Unattractive" moat - filmmakers, management and Hollywood studios may see documentaries as unattractive & dull compared to the next action flick. The industry has moved away from Factual content to Reality TV. Hendricks, the founder of Curiosity, started it in the first place because his previous company Discovery Channel began to do more reality TV. So as the rest of the market increasingly goes in one direction, CURI becomes more differentiated.

- Management & Culture. The founder of Curiosity is the founder of Discovery Channel - lots of networks. Strong undivided self-imposed focus on factual content. Related to point 1.

- Developing Brand. Not a moat yet, but no doubt they want Curiosity to be the best place to get documentaries on the Web. In the 2000s - the cable brands were Discovery Channel, Animal Planet, and National Geographic. I think the 2020s and beyond can belong to CURI.

- Network Effects/ Economies of scale. More subscribers mean CURI acquires/produces more documentaries which in turn means more and better documentaries. Why subscribe to a service with less content? Curi is a business that naturally compounds value over time.

- Differentiated customer acquisition. Strategic partnership with Nebula. Nebula's YouTubers have 200 million subscribers in cumulative reach; these subscribers love factual content. Other factual SVODs don't have access to this.

- Switching Cost. People are lazy/forget to cancel a subscription.

A note about moats in the Entertainment Industry

They say content is king. However, this is untrue generally, as content production is undifferentiated. Anyone with a camera and a good eye can technically make films. Content is a kingmaker, and content distribution - originally cinemas, cable and broadband- is a more stable competitive advantage. In the modern age, SVODs or platforms like MVPDs are the gatekeepers that have the distribution to reach customers.

In conclusion, CURI has $152M in book value, of which 66M is pure cash, while its equity is only 64M at the current market cap. Even if you’re sceptical that CURI can ever generate serious money, it is already severely underpriced. It is not hard to imagine it will break even. Furthermore, CURI market positioning is solid; there is upside for free if you believe CURI can continue to grow and generate significant cash.

Disclosure: I am taking a long position in CURI.